The Inflation Reduction Act allocates rebates and tax credits to residents and households based on income.

For new electric vehicle purchases, there is an income limit in order to qualify for the tax credits ($300,000 adjusted gross income on a join tax return, and $150,000 for single tax returns).

Rebates for efficient appliances use area median income to determine the amount of rebate a household is eligible for.

- If a household's income is over 150% of the area median, they aren't eligible for rebates.

- However if a household's income is below 80% of the area median they may receive a rebate for the full cost of their upgrade, up to $14,000.

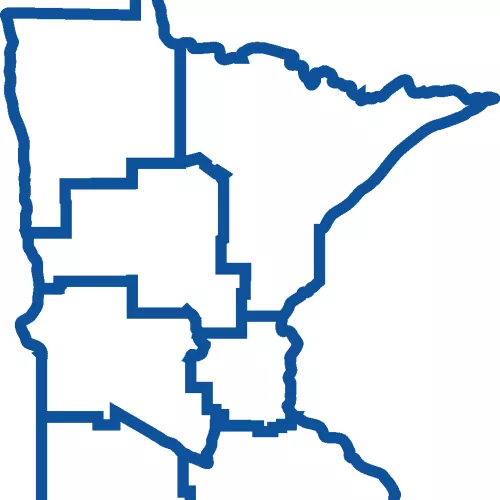

So how do you figure out your area median income?

The area median income is the midpoint of a designated region’s income distribution — half of households in the region earn more than the median and half earn less than the median.

Download this chart of 2024 AMI for Minnesota residents [PDF]